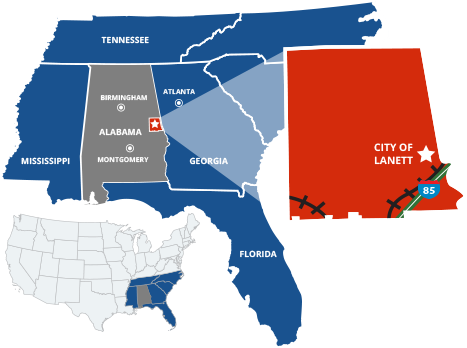

WELCOME TO THE CITY OF LANETT,

THE GATEWAY TO ALABAMA.

Lanett was originally the Town of Bluffton, incorporated on December 7, 1865, when it received its charter from the Alabama Legislature. A new charter was sought from the state twenty-eight years later, as Bluffton had grown and citizens of the town deemed fit to change its name. The City of Lanett was officially founded on February 1, 1895. Lanett was named after two local textile mill developers, Lafayette Lanier and Theodore Bennett.

Located on Interstate-85 and on the shores of the Chattahoochee River on the Alabama-Georgia line, today, Lanett serves as a hotbed for industry, small business and recreation.